Keisha Credit offers five tips for small businesses to succeed in the wake of coronavirus and in the event of a full national lockdown.

Are you interested in real estate investment? Although the economy is a bit rocky, here are a few things to keep in mind when considering multi-family property buys.

Financial experts Tonya Rapley and Belva Anakwenze share essential information to help you better understand the changing economic landscape of this tax season due to the coronavirus pandemic.

With the current market, many are speculating a recession is on the way. Not to worry because financial experts Tonya Rapley and Kevin L. Matthews II are providing the basics of investing and tools to help you build wealth during a financial crisis.

Equipping you with financial fundamentals to help maneuver the current economic climate, millennial money expert Tonya Rapley created the online series Leveling Up in Uncertainty.

With the global coronavirus pandemic, money expert and creator of My Fab Finance Tonya Rapley shares her tips on the best financial decisions to make due to the current economic crisis.

With hard work and dedication, they got out of $100,000 worth of debt. Then, it happened again. But this time, they learned that abundance is a mind game.

Old habits die hard, and the sooner you can nip some things in the bud, the less stressful finances become because there’s expectations set.

Here come the holidays, and here comes money being spent and love being shown through purchases and payment plans. Holiday sales are set up to make us think we are saving money, but are we really making the best decisions for our family’s financial health and longevity? Ashley Chea is here to help us answer that question with five tips on how to avoid overspending this holiday season. Holiday sales are set up to make us think we are saving money. Also, at no time is spending money saving money. We get so hyped up and tell ourselves we got a discount, but in reality, if we didn’t spend the money in the first place we would still have it. I’m not saying you shouldn’t buy anything. I am saying let’s take a moment to spend wisely and to find a way to enjoy the holidays without feeling depressed over money spent or not having the money to spend in the first place. Here are five tips I use during the holiday, and really all year round, to make sure I am spending wisely and, more importantly, not living in excess.

Kevin Cohee, chairman and CEO of OneUnited Bank, provides money management tips on building wealth and achieving financial freedom in the Black community.

How do you define financial success? In “Financial Freedom”, staging-blacklove.kinsta.cloud financial expert Tonya Rapley’s answer may surprise, and encourage, you.

Too often we don't recognize financial abuse as an issue. Tonya opens up about her experience and shares how she escaped a financially abusive relationship.

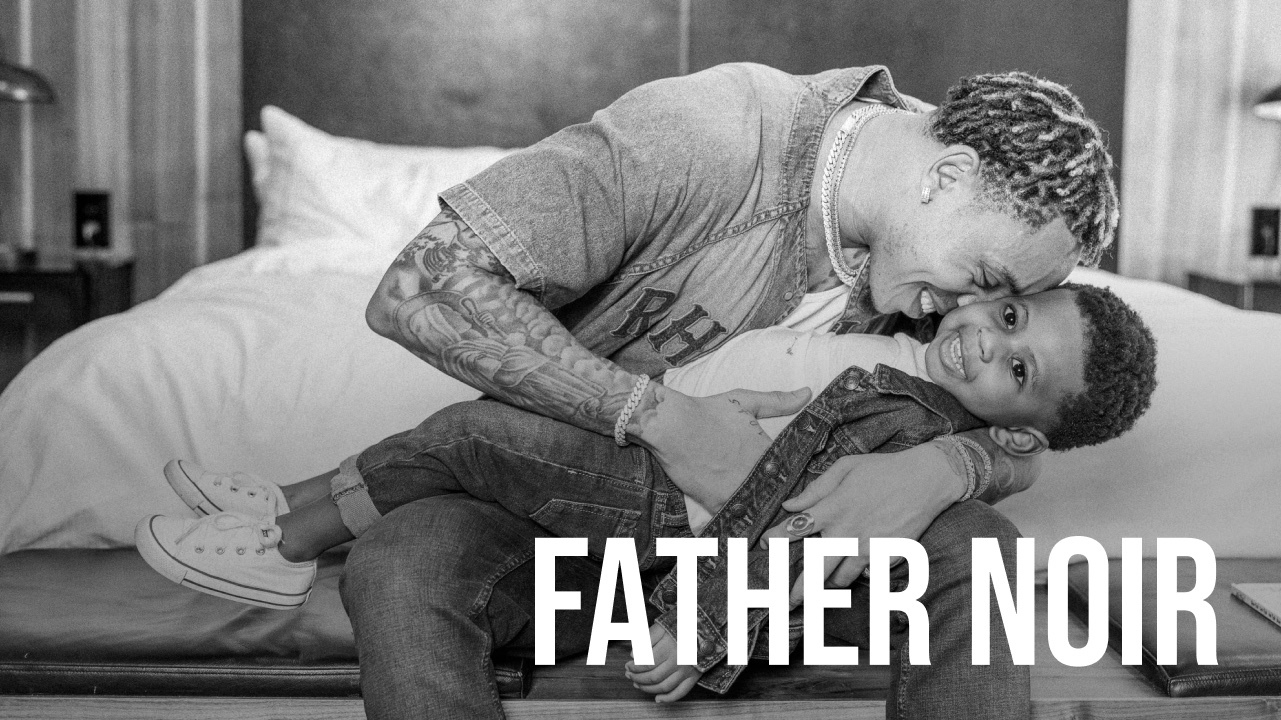

On All Things Money, Tonya Rapley shares the financial tips, tools and strategies you need to make sure your relationships and your bank account are strong.